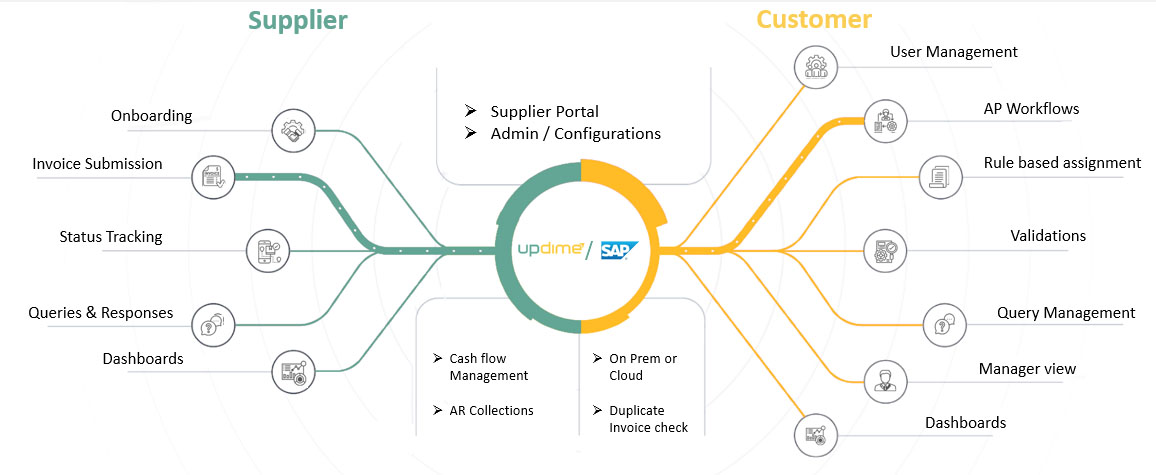

AR/AP Automation Services

Tecnics simplifies AP and AR automation, significantly enhancing financial operations within SAP systems and boosting efficiency and accuracy. AP automation reduces manual interventions and error rates in invoice and payment processing. It simplifies tasks such as invoice creation, payment receipt, and reconciliation, thus optimising cash flow. Moreover, it refines invoice matching, approval processes, and payment execution, while AR automation advances cash flow management.

Accuracy

Tecnics assists organisations in achieving accuracy in AR AP automation within SAP, ensuring transactions are processed precisely, minimising errors and enhancing compliance. This support leads to accurate invoicing, prompt payments, and reliable financial reporting, fostering stakeholder trust. Such accuracy optimisation benefits cash flow management and bolsters strategic financial decisions, significantly enhancing business performance.

Simplified Work Flow

Tecnics aids organisations in achieving a simplified workflow in AR AP automation within SAP, enhancing efficiency and usability. By reducing manual tasks, speeding up transactions, and improving financial oversight, Tecnics ensures a more streamlined and error-minimized process. This advancement boosts productivity, offers timely financial insights, and fosters a more effective and responsive financial management framework.

Enhanced Visibility

Tecnics assists organisations in achieving enhanced visibility in AR AP automation within SAP, providing a transparent, detailed perspective on financial transactions. This clarity empowers businesses with improved tracking, informed decision-making, and strategic planning capabilities. By identifying trends and pinpointing potential issues, Tecnics drives better financial health and operational efficiency, fostering a more informed and proactive financial management approach.

Improved Compliances

Tecnics is pivotal in aiding organisations in enhancing compliance in AR/AP automation within SAP, ensuring adherence to evolving financial regulations and standards. By streamlining data validation and record-keeping, Tecnics helps maintain accuracy and transparency, simplifying regulatory reporting and reinforcing accountability. This support is crucial in safeguarding an organisation's reputation and financial integrity.